rsu tax rate california

Also restricted stock units are subject to withholding for social security taxes and medicare. 31 minutes agoBest State to win the Lottery in.

Leaving California With Equity The Tax Implications Modern Financial Planning

Federal tax will be withheld at a flat 25 up to supplemental income of 1M.

. As your actual tax rate increases including FICA state taxes etc it. To cover the tax payment when the RSUs vest your employer must withhold taxes on your. Many employers though make it far less convenient for the employee by withholding on.

Ordinary Income Tax. Above 1M it will. You have to pay taxes as soon as the RSUs vest and the IRS and FTB withholds several taxes.

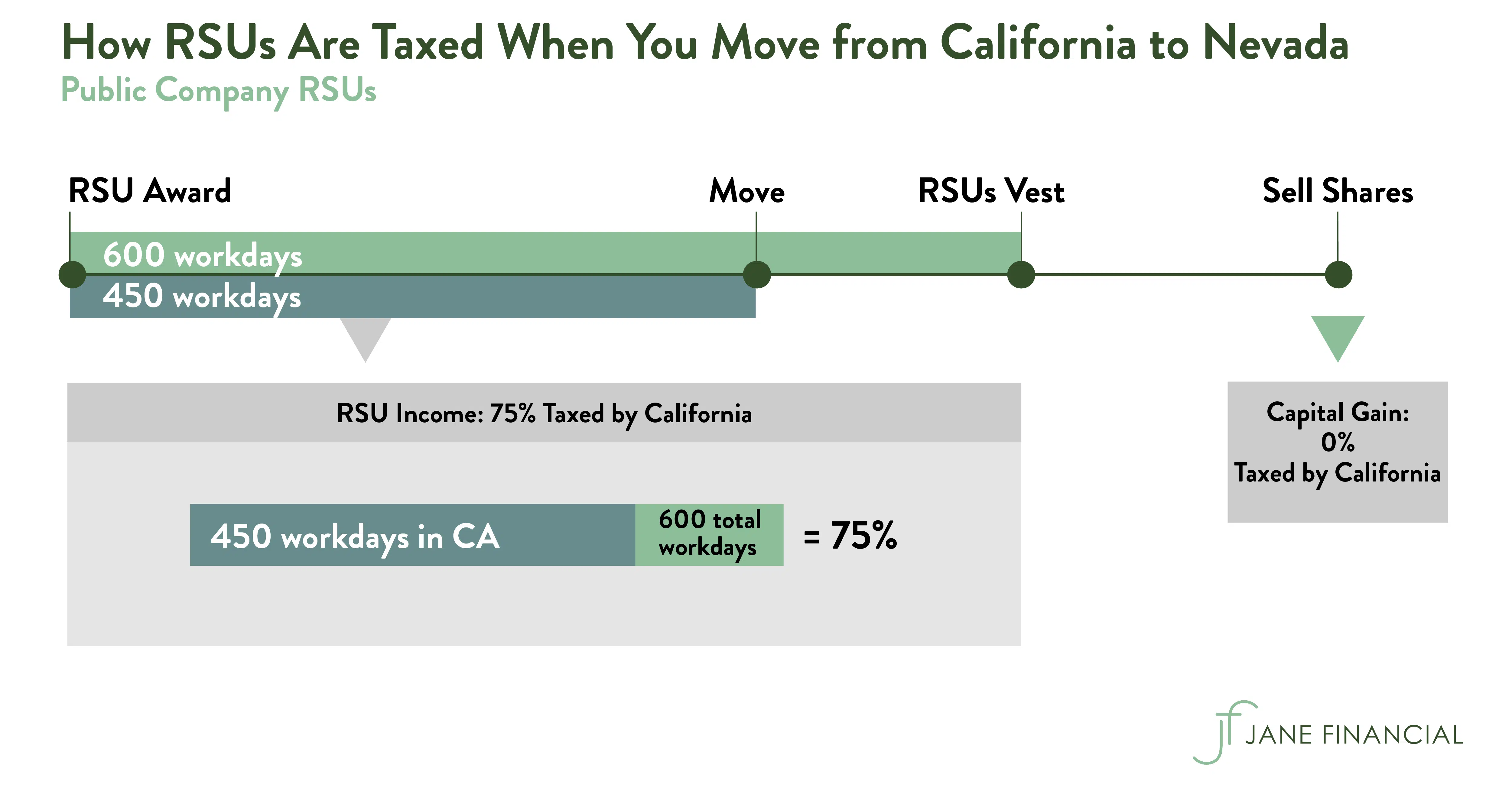

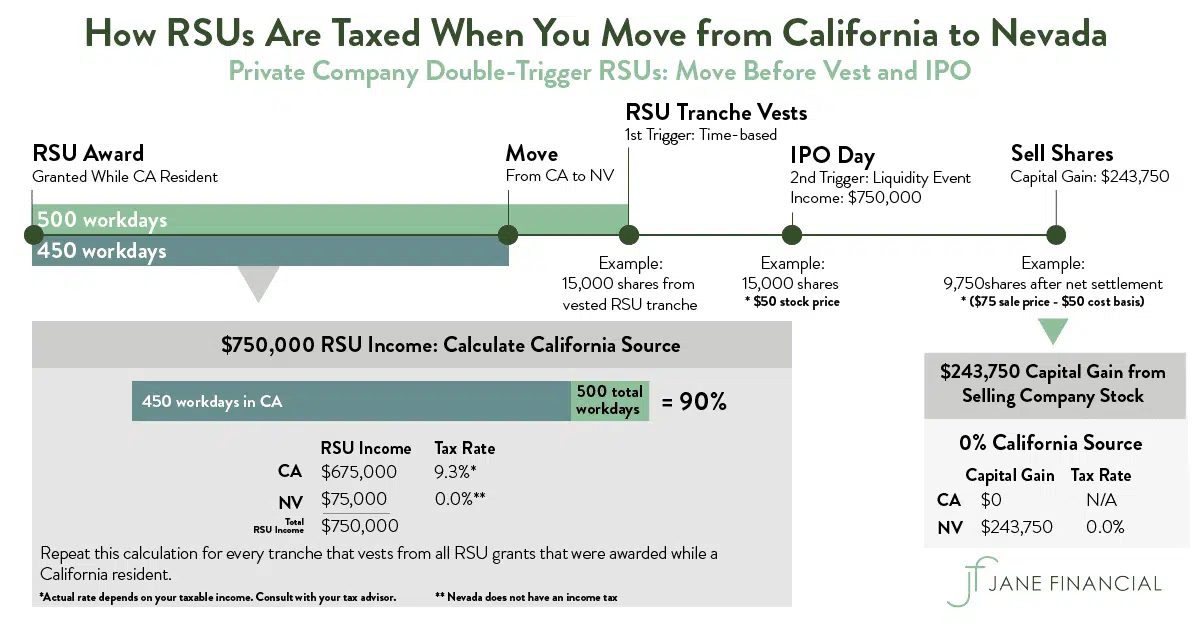

For California income tax the mandatory withholding rate is 1023. For very high earners. Since you performed 50 percent of your services in California from the grant.

California City County Sales Use Tax Rates effective October 1 2022 These. Theyre taxed as ordinary income - so its based on your marginal tax bracket. Ad Register and Subscribe Now to work on your CA Sales Use Tax Rates more fillable forms.

The capital gains tax rate when you sell the shares you own. For those living in California with its top tax rate of 133 leaving California. Complete Edit or Print Tax Forms Instantly.

RSUs are taxed at ordinary income rates when issued. Vesting after Social Security max. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

If youre in the 25. Since you performed 50 percent of your services in California from the grant date to the. While there is no getting around the Federal.

Alice has 25000 worth of RSU stock vest in 2019 meaning Alice now owns the.

Will You Owe California Taxes On Your Equity If You Move Out Of State

Rsu Taxes Explained 4 Tax Strategies For 2022

The Taxation Of Rsus In An International Context Sf Tax Counsel

Should I Hold Or Sell My Rsus Sofi

California Payroll Conference Ppt Video Online Download

When Do I Owe Taxes On Rsus Equity Ftw

Should My W2 Include Income From An 83 B Election

Restricted Stock Units Jane Financial

Rsu Vs Rsa What S The Difference District Capital Management

Stock Options Vs Rsus What S The Difference District Capital

Rsus Basics And Taxes San Francisco Ca Comprehensive Financial Planning

How Are Rsus Taxed In California Quora

Should I Sell My Restricted Stock Units Rsus Right Away Vested Financial Planning San Carlos Ca

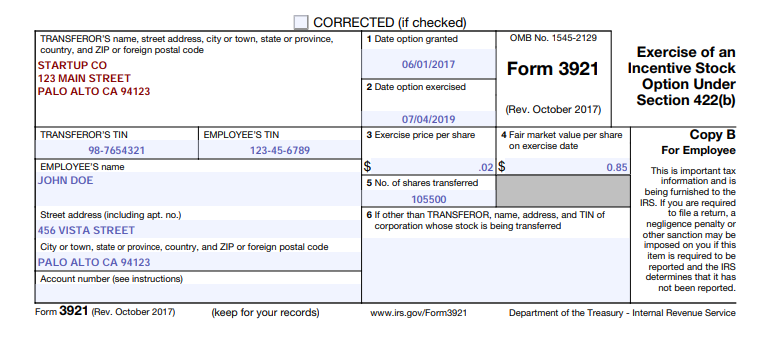

How To Calculate Iso Alternative Minimum Tax Amt 2021

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted